Financial Wellness and Retirement Manager

Responsibilities include strategic design related to the health system’s retirement plans, all financial wellness programs, and scoping of possible employee recognition and appreciation program. This position will be responsible for leading a small team dedicated to financial wellness and retirement administrative duties. Participate in Plan Design with respect to participants, eligibility, matching vesting, withdrawals, etc, and manage the day-to-day administration and planning activities for the Retirement Savings Plans, including coordinates, compiles and manages all plan census information, including participant enrollment and vesting. Reviews and advises on plan rules including contribution limits, benefit restrictions, distributions, loans, and hardships. Prepares plan documents, notices, and amendments. Fulfills fiduciary governance tasks as Plan Administrator and Secretary of the Retirement Benefits Committee (e.g. regular fee reviews, review of vendor requests for proposals, keeping/ratifying meeting minutes, recommending plan amendments/resolutions, etc.) and makes recommendations to improve competitive position and/or legal compliance, including acting as an internal consultant and expert for retirement benefits and fiduciary responsibility best practices and market competitiveness, analyzing benchmark surveys and market, economic and plan financial data to identify trends and improvement opportunities and working with finance to ensure enhancements are budgeted and accounted for properly. Will lead all financial wellness related programs, in addition to partnering with the Wellness team on financial wellness programming and planning. Responsible for creating and delivering retirement and financial wellness related education sessions to leaders and employees. Will partner with our corporate communications teams on retirement and financial wellness communication strategy and delivery to our employee population. Responsible for scoping an employee appreciation and recognition program. In addition, this role is responsible for all transition and/or termination of retirement plans related to future integration and acquisitions.

Responsibilities:

*Must be able to perform the professional, clinical and or technical competencies of the assigned unit or department.

*Note: These statements are intended to describe the essential functions of the job and are not intended to be an exhaustive list of all responsibilities. Skills and duties may vary dependent upon your department or unit. Other duties may be assigned as required.

- Participate in Plan Design with respect to participants, eligibility, matching vesting, withdrawals, etc, and manage the day-to-day administration and planning activities for the Retirement Savings Plans, including coordinates, compiles and manages all plan census information, including participant enrollment and vesting. Respond to complex retirement benefit questions and correspond with vendors to resolve issues.

- Manage quarterly retirement plan administrative and plan performance reviews with all stakeholder parties. Fulfill fiduciary governance tasks as Plan Administrator and Secretary of the Retirement Benefits Committee (e.g. regular fee reviews, review of vendor requests for proposals, keeping/ratifying meeting minutes, recommending plan amendments/resolutions, etc.). Manage quarterly retirement plan administrative and plan performance reviews with all stakeholder parties.

- Make recommendations to improve competitive position and/or legal compliance, including acting as an internal consultant and expert for retirement benefits and fiduciary responsibility best practices and market competitiveness, analyzing benchmark surveys and market, economic and plan financial data to identify trends and improvement opportunities and working with finance to ensure enhancements are budgeted and accounted for properly.

- Manages inbound and outbound files with Third Party administration, reconciles each contribution file from all retirement plans, and conduct quarterly comprehensive audits of all retirement plans. Responsible for the review and final processing of withdrawals, distributions, and loan requests from the retirement plans.

- Develop and implement annual financial wellness and retirement education and engagement calendar of activities to maintain and enhance participant engagement and expand availability of retirement information and education to employees by developing financial education/financial wellness strategy.

- Ensures accurate eligibility and enrollment of all eligible participants and ensures both the employee and the employer contribution levels are accurate based upon years of service. Monitors the forfeiture accounts and applies employer contribution credits at the appropriate time.

- Prepares plan documents as needed including notices and amendment, including administration procedures and guidelines; and manages all participant communications

- Develops audit protocols for all benefit and retirement programs; establishes a regular audit schedule and conducts audits according to schedule; maintains a report of audit findings and corrections; oversees audit corrections and ensures all audit corrections are made; recommends changes to established procedures as required by audit findings.

- Retirement Savings Plans: Stays current and maintains up-to-date industry knowledge via outside reading as well as attendance at educational seminars and classes.

- Responsible for creating/delivering all retirement and financial wellness related programs and communications, education series related to financial wellness or retirement benefits, and leading integrations/acquisitions.

- Will be responsible for a variety of other programs and benefit offerings related to financial wellness including an employee discount program at a local and national level, earned wage access program, tuition reimbursement and certifications, back-up childcare offerings, and other potential future programs including an employee recognition and appreciation program. In addition, will be responsible for maintaining external and internal partnerships with key contacts and vendor partnerships.

JOB REQUIREMENTS

Required

- Bachelor's Degree in Business or related field

- Minimum 5 years of experience with direct responsibility for the administration of retirement plans

- Demonstrated expertise with standard concepts, practices, and procedures related to defined contribution plan administration, management and governance

- Strong excel skills to write and create reports, analyze reports, manipulate data, prepare contribution files, audit to ensure accuracy of contribution files

- Strong understanding of Third Party Administrator, Plan Sponsor, broker, investment, fiduciary and participant roles and responsibilities in qualified plans

- Strong understanding of eligibility, enrollment, contribution, match, forfeitures, testing, correction and plan documents

- Strong financial acumen, aptitude for data and numbers, and extremely organized and detail oriented - Excellent computer skills, expert level user with Microsoft Office

- Proficient user of retirement program software and other types of benefit management systems, and various types of data base management systems

- Excellent written and verbal skills, strong analytical and interpretive skills; Outstanding interpersonal skills with an ability to work within a team environment and receive high customer satisfaction ratings

- Ability to handle work-related stress and thrive in a fast-paced environment

- Ability to handle multiple priorities simultaneously

Preferred

- Advanced knowledge of Employee Retirement Income and Security Act, Department of Labor and Internal Revenue Service regulatory issues

We are an equal employment opportunity employer without regard to a person’s race, color, religion, sex (including pregnancy, gender identity and sexual orientation), national origin, ancestry, age (40 or older), disability, veteran status or genetic information.

- Scheduler Admitting Rep Shawnee Mission, Kansas

- Scheduler Admitting Rep Shawnee Mission, Kansas

- Senior Graphic Designer Shawnee Mission, Kansas

You don't have any recently viewed jobs yet. You don't have any saved jobs yet.

You don't have any recently viewed jobs yet. You don't have any saved jobs yet.

-

All About Ambulatory Pharmacy

All About Ambulatory Pharmacy -

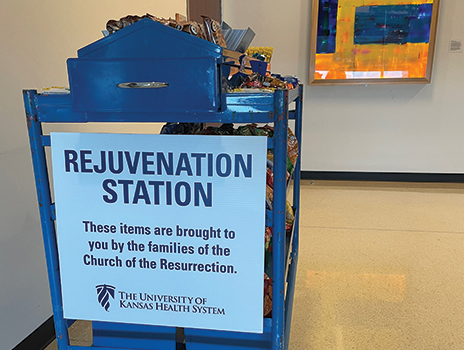

Toby's Take: Caring for the Caregivers

Toby's Take: Caring for the Caregivers -

Additional Clinical Opportunities

Additional Clinical Opportunities -

Residency and Fellowship Programs Non-Nursing

Residency and Fellowship Programs Non-Nursing -

A look into the life of an ER Nurse

A look into the life of an ER Nurse -

Employee Testimonials

Employee Testimonials -

Business & Professional

Business & Professional -

Hospitality Services

Hospitality Services -

IT

IT -

Interventional Radiology

Interventional Radiology -

Nursing

Nursing -

Nursing Acute Care - Kansas City

Nursing Acute Care - Kansas City -

Critical Care/ICU/ER

Critical Care/ICU/ER -

Emergency - Great Bend

Emergency - Great Bend -

Graduate Nurses/ Residency

Graduate Nurses/ Residency -

Maternal and Child Services Division - Kansas City

Maternal and Child Services Division - Kansas City -

Maternal and Child Services Division - Great Bend

Maternal and Child Services Division - Great Bend -

Cancer Center

Cancer Center -

Pathways to Nursing

Pathways to Nursing -

Perioperative and Procedural Services - Kansas City

Perioperative and Procedural Services - Kansas City -

Perioperative and Procedural Services – Great Bend

Perioperative and Procedural Services – Great Bend -

Advanced Practice Professionals - Great Bend

Advanced Practice Professionals - Great Bend -

Advancement Opportunities

Advancement Opportunities -

Ambulatory & Outpatient - Kansas City

Ambulatory & Outpatient - Kansas City -

Ambulatory & Outpatient

Ambulatory & Outpatient -

Behavioral Health

Behavioral Health -

Cardiovascular Care

Cardiovascular Care -

Physicians & Faculty

Physicians & Faculty -

Mission & Values

Mission & Values -

Our Culture

Our Culture -

Benefits

Benefits -

Diversity & Inclusion

Diversity & Inclusion -

History

History -

Our Hiring Process

Our Hiring Process -

Advanced Practice Professionals

Advanced Practice Professionals -

Awards

Awards -

Allied Health

Allied Health -

-

Our Hiring Process

Learn More -

Benefits

Learn More