At The University of Kansas Health System, what you bring makes all the difference – for patients, families and our community. By joining our physicians, nurses, researchers, educators and other professionals, you’ll be empowered to use your skills and passion to help provide extraordinary care. As part of the region’s premier health system, you’ll understand that your work leads to more options today, and more hope for tomorrow.

We welcome you to learn more – and be part of what’s next.

Career Areas

Clinical Non-Licensed

Advanced Practice Professionals

Health Professions/Allied Health

Business & Professional

Hospitality Services

Information Technology

Interventional Radiology

Physicians & Faculty

Residency & Fellowship Programs & Non-Nursing

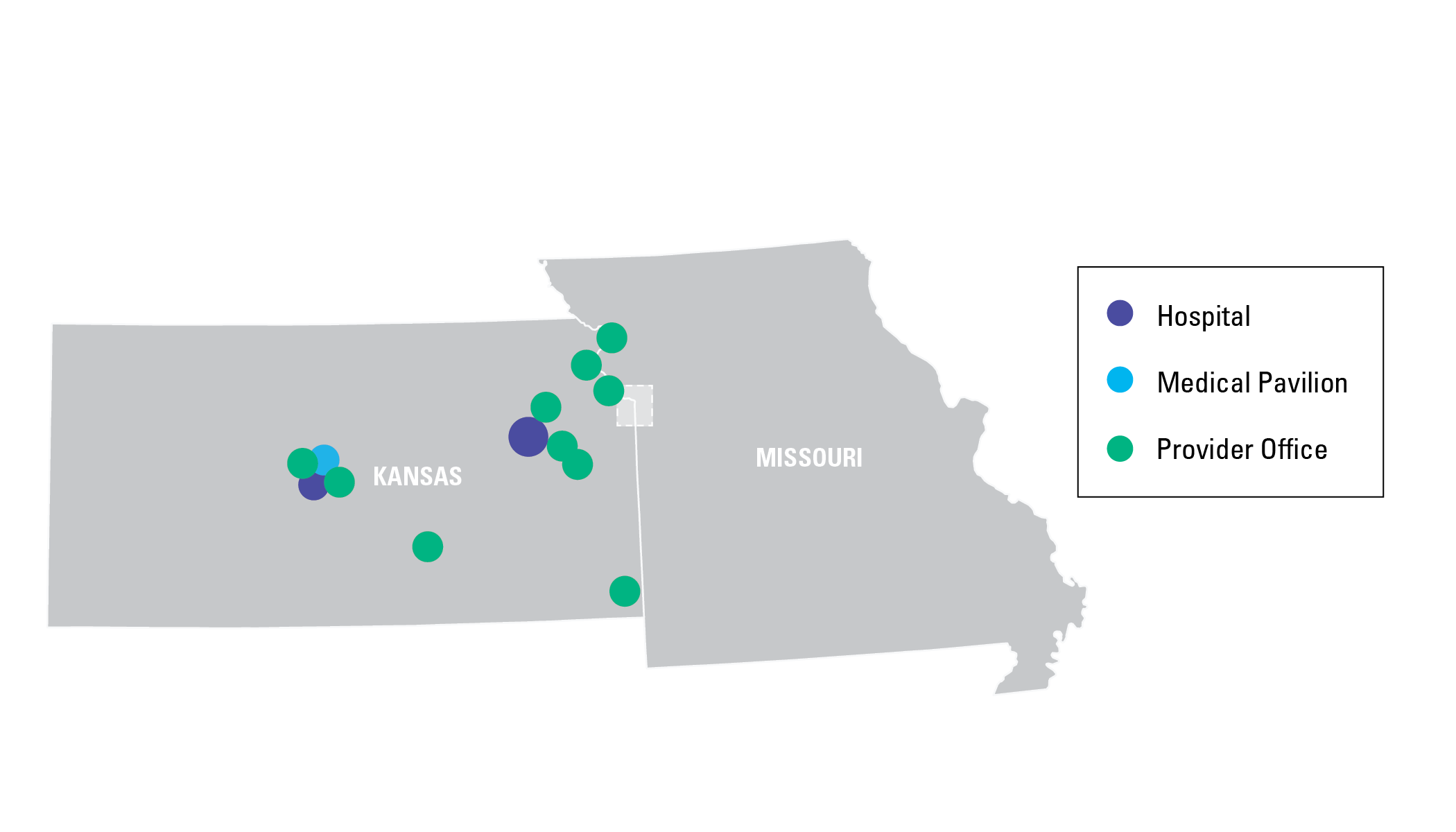

A Wealth of Locations

On our team, you’ll discover nearly endless opportunities to develop your career within our health system. With hospitals and clinics throughout the metropolitan area – as well as in Great Bend, Lawrence, and Topeka – you’ll have plenty of room to grow. Learn more about our locations.

A Legacy of Excellence

Being part of an academic health system makes a difference in your work, every day. Our standing means we truly function as a team – physicians, nurses, researchers, educators and other professionals – to solve the most challenging problems with evidence-based solutions. And of course, you’ll have access to powerful, formal and informal learning opportunities. Find out more about who we are and how we became what we are today.

Many for our Mission

We recognize that solving the greatest medical challenges will take the many different voices, opinions and perspectives of those who work here and of the communities we serve. Learn more about how we honor and celebrate our uniqueness.

Our Culture of Equity in Healthcare

For the last 5 years, we’ve been recognized for the equitable and inclusive care we provide for LGBTQ patients and their families by the Healthcare Equality Index (HEI).

Healthcare Equality Index 2022 – Human Rights Campaign (hrc.org)

You don't have any recently viewed jobs yet. You don't have any saved jobs yet.

You don't have any recently viewed jobs yet. You don't have any saved jobs yet.

I wanted a job where I could actually see the people I was helping, and help them directly. I've had X-rays before, and I thought I could take my experience as a patient and help make those people's days a little better for the 5-10 minutes I see them."Radiologic Technologist

-

History

From our humble beginnings over a century ago to our standing now as the region’s premier academic medical center, our journey is one of continual growth and advancement.

Learn More -

Mission & Values

Everything we do is shaped by our mission and values. Learn more about what inspires us in our work.

Learn More -

Our Culture

Working at The University of Kansas Health System, you’ll experience an environment of teamwork and support. No matter what your role, your work will make a difference – to our patients, to our team members and to our community. Learn more about our culture and find out where you can fit in.

Learn More